Risk Management Software

Risk management, FMEA, risk analysis, and HACCP in one software including root cause analysis, risk matrix, structure analysis, and function network. Use the comprehensive functions of the software Risk.Net in order to identify, evaluate, and document relevant risks and thereby fulfil key requirements of customers and regulating authorities. Whether ISO 9001, ISO 13485, GMP, IFS, or IATF 16949: Risk.Net is a risk management software solution that enables you to create and manage any type of standards-compliant risk analysis.

Advantages of the Risk Management Software

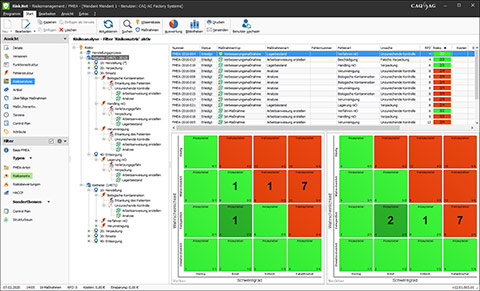

DIN EN ISO 14971 risk analysis methods (before/after matrix), FMEA evaluations, RPN/Pareto diagrams, risk matrices, and 3D signal light factors

DIN EN ISO 14971 risk analysis methods (before/after matrix), FMEA evaluations, RPN/Pareto diagrams, risk matrices, and 3D signal light factors

- Risk analyses via structure, function, and failure analysis

- Confirmed suitability for the creation of AIAG / VDA compliant FMEAs

- Risk assessment in accordance with RPN or Action Priority (AP)

- Risk analyses with Before / After Risk Matrix

- Decision tree for establishing CCP, PRP, and oPRP in the context of HACCP

- Determine priorities via risk matrices and 3D signal light factors

- Root cause analysis with Ishikawa-Diagrams and 5-Why-Method

- Guided linkage and auto-update of control plan and inspection plan

- Integrated knowledge and revision management ensure traceability

Functions of the Risk Management Software

We all conduct risk analysis in our everyday lives. Every time we weigh up the probability of something happening and the resulting degree of severity, we are conducting risk analysis. Within the area of risk management, techniques such as FMEA, 3D signal light factors, HACCP, or ISO 14971 risk matrices are used in order to weigh up precisely these types of correlation between probability and severity, and to ascertain appropriate risk parameters. Whether automotive, medical technology, or food industry: in Risk.Net you have the best risk analysis methods of all sectors at your disposal, so that you can identify, analyze, and classify all risks and hazards.

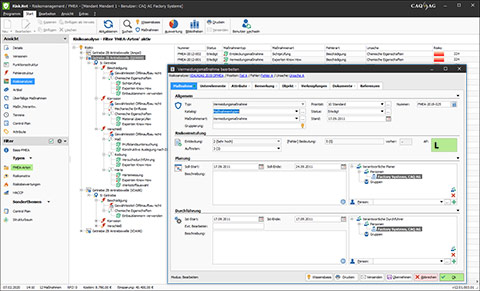

AP classes: High (H), Middle (M), and Low (L)

AP classes: High (H), Middle (M), and Low (L)

In addition to the direct link between risk analysis, control plan, and inspection plan, there is, true to the concept of PDCA, another control loop that can be used as input for risk analyses. The inspection plans from Compact.Net trigger process violations and complaints in the Complaint Management System REM.Net, and complaints from REM.Net, in turn, are used as a knowledge base for the creation and revision of risk analyses and FMEAs in Risk.Net. This ensures that improvements in quality and safety can be implemented continuously.

Each CAQ.Net Module Puts the Following at Your Disposal

- Management of systemwide actions and tasks

- Definition of attributes for all relevant entities

- Configuration of role concepts and access rights

- Use of multilingual application & transaction data, incl. translation tool

- Application in multi-tenant mode for cross-location and cross-database scenarios

- Modification of module-specific content and interfaces

- Creation and modification of reports and e-mail templates

- Analysis and evaluation of systemwide data across all CAQ.Net applications

- Data validation via Audit Trail

- Automated data exchange with existing IT-systems and infrastructures

Standards-Compliance of the Risk Management Software

- DIN EN ISO 9001

- DIN EN ISO 13485

- DIN EN ISO 14971

- ISO 22000

- FSSC 22000

- ISO 31000

- IATF 16949

- FMEA (VDA / AIAG)

- DIN EN ISO 12100

- DIN EN 9100

- DIN EN ISO/IEC 17025

- FDA 21 CFR Part 820

- FDA 21 CFR Part 11

- GMP

- IFS

- More Regulations »

Risk Management FAQ

We all conduct risk analysis in our everyday lives. Every time we weigh up the probability of something happening and the resulting degree of severity, we are conducting risk analysis. If you leave the house when it is raining, the prospect of getting wet is very high. The degree of severity, however, is low. You’ll simply get wet. If you don’t put on your safety belt in the car, the probability of something happening is comparatively low. However, if something does happen, the severity of what may happen can be dramatic. Within the area of risk management, techniques such as FMEA, 3D signal light factors, HACCP, or ISO 14971 risk matrices are used in order to weigh up precisely these types of correlation between probability and severity, and to ascertain appropriate risk parameters.

In previous FMEAs, the respective risk was always determined on the basis of the known risk priority number (RPN) by multiplying the three factors significance (B), occurrence (A), and detection (E). In the course of the elaboration of IATF 16949 by AIAG and VDA, among other aspects, the Action Priority (AP) was designed as a replacement of the formerly predominant RPN. Compared to the RPN, the AP has three so-called “AP classes”: High (H), Middle (M), and Low (L). These new task priorities do not determine the level of risk, but instead prioritize the respective need for measures to reduce the risk. In Risk.Net, you can perform risk analyses using both the previously valid RPN and the Action Priority (AP).